AML compliance that can be proven – automatically and without friction.

Qapla is an automated AML system for Swedish accounting firms. Always inspection-ready, fully auditable, and designed for real AML inspections.

No credit card • No binding • Fast start

Built specifically for Swedish accounting firms

Designed for real AML inspections and regulatory compliance

Most firms have documentation – but it's not enough to avoid sanctions

Most firms have AML routines. But when inspectors arrive, they can't prove what they did.

Firms often have routines

Analysis of 29 Swedish accounting firms sanctioned by Länsstyrelsen shows: most firms already have AML procedures and checklists in place. They know what needs to be done and they do it regularly.

But when inspectors arrive, they cannot show:

- ✗What applied on a specific date

- ✗Who approved the routines and when

- ✗Which risk assessment the routines were based on

- ✗Complete audit trail of all AML actions

- ✗Version history of policies and procedures

Sanctions are a documentation and traceability problem

Firms are not sanctioned for lacking routines – they are sanctioned for not being able to prove them. Analysis shows 100% of sanctioned firms had risk assessment deficiencies, and 97% had documentation problems.

Example: Accountor received a 5,000,000 SEK fine for systematic deficiencies across all AML areas – not because they lacked routines, but because they couldn't prove compliance.

The Solution: Everything You Need to Show Inspectors – In One Place

When inspectors arrive, you can show exactly what applied when, who approved it, and why. Everything is connected and tracked automatically.

What you can show inspectors:

Your Risk Assessment

Which risk assessment applied on a specific date – with complete history

Your Routines and Controls

Which routines existed, when they were approved, and who approved them

Your AML Manual

Automatically generated and always up to date – linked to your risk assessment

How it works:

Everything is Connected

Risk assessment, routines, and manual are automatically linked. You don't need to connect them manually.

Everything is Saved with Dates

You can always show what applied on a specific date. No guessing, no relying on memory.

Everything is Approved and Tracked

Every change is approved by someone, with date and time. Complete traceability for inspectors.

It's That Simple

Three steps – then you're always ready when inspectors arrive

1. Approve Your Risk Assessment

You do your risk assessment and approve it. The system saves the date and who approved it – so you can always show when it was done.

2. Follow the Checklist for Your Routines

You follow a simple checklist for your AML routines. The system automatically links the routines to your risk assessment – so inspectors see everything is connected.

3. Your AML Manual is Created Automatically

Your AML manual is created automatically based on your risk assessment and routines. It updates when something changes – always current, always provable.

That's it. When inspectors arrive, you can show everything they need to see – immediately.

See How It Works

Explore how Qapla helps you prove your AML compliance—from risk assessment to inspection readiness.

Select a feature to learn more

4 features

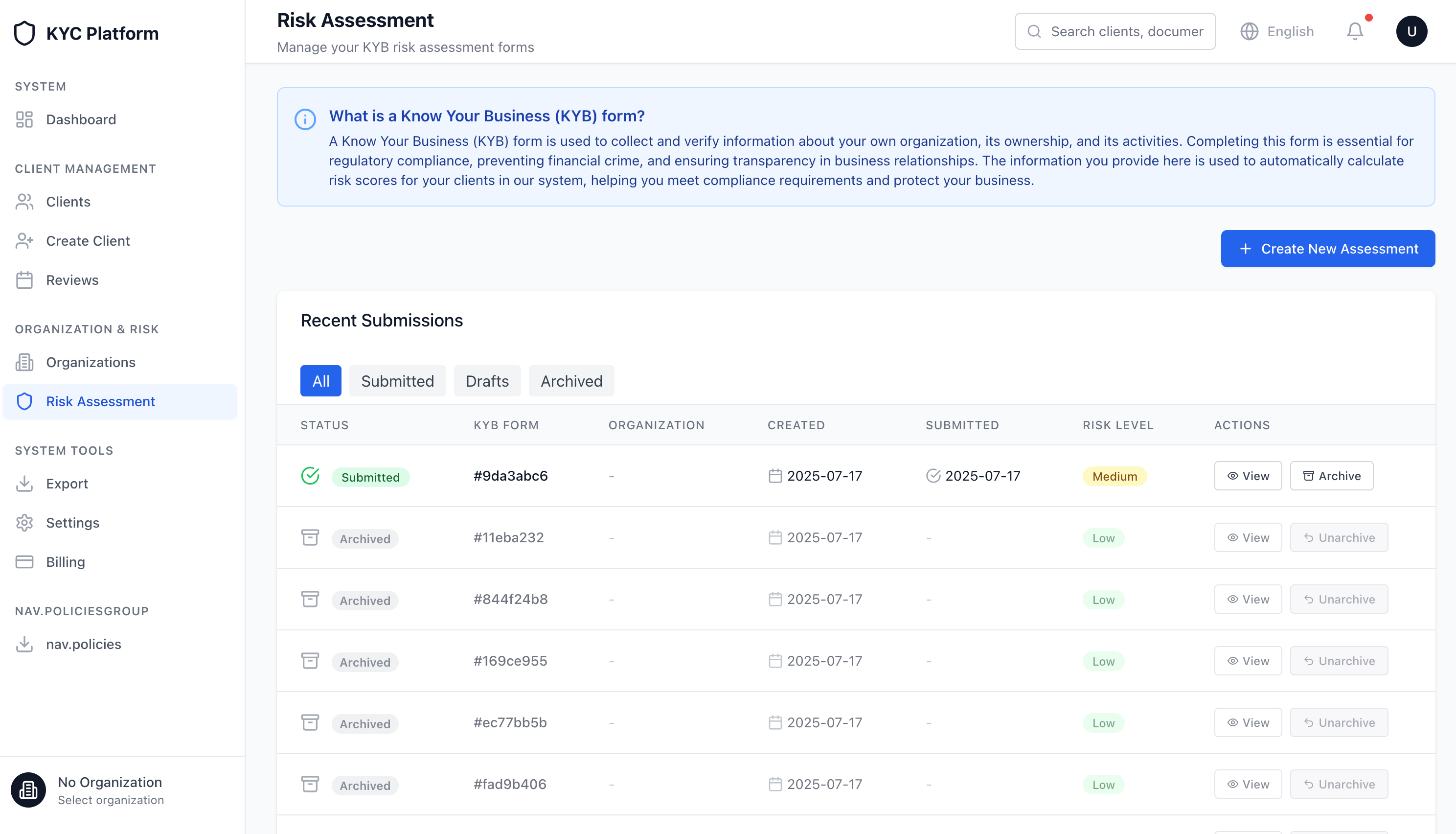

General Risk Assessment (GRA/ARB)

General Risk Assessment (GRA/ARB)

Get a complete, inspection-ready risk assessment document. The system calculates risk scores automatically as you evaluate business exposure, client segments, geographies, and delivery channels—all in one place.

Key Benefits

- Always inspection-ready risk assessment document

- No manual calculations—system handles risk scoring automatically

- Complies with Swedish AML Act requirements automatically

- Prove what applied on any date with complete approval history

This is example data. Your own AML structure is created automatically when you start the free trial.

Select a feature to learn more

4 features

No credit card • No binding • Fast start

The System Keeps AML Correct for You

You don't track AML – the system does.

Automatic Detection

The system automatically detects when policies become outdated or need updates.

Exact Visibility

See exactly what changed, when it changed, and why it needs your attention.

One-Click Re-approval

Review changes and re-approve with a single click. Full audit trail maintained automatically.

Set It and Forget It

Once your AML routines are set up, the system monitors and maintains them. You focus on your clients – we handle the compliance tracking.

Why Qapla? Real Outcomes That Matter

Focus on what matters: reduced risk, less work, and peace of mind.

Lower Sanction Risk

Always be able to prove your AML routines. Reduce the risk of sanctions by having complete documentation and audit trails.

Always Inspection-Ready

When inspectors arrive, you can immediately show what applied when, who approved it, and why. No scrambling, no stress.

Less Administrative Burden

The system handles versioning, tracking, and documentation automatically. Spend less time on compliance paperwork.

Easy for Staff

Simple, guided workflows that anyone can follow. No complex training needed – just follow the checklist.

Scales with Complexity

Whether you have 10 clients or 1000, the system adapts. More clients don't mean more compliance headaches.

Plans and Pricing

Start with a one-month free trial. No commitments, cancel anytime.

Up to 20 clients

- All AML features

- Automatic risk assessment

- Screening against PEP and sanctions lists

- Automatic AML manual

- Complete audit trail

Up to 50 clients

- All AML features

- Automatic risk assessment

- Screening against PEP and sanctions lists

- Automatic AML manual

- Complete audit trail

Up to 100 clients

- All AML features

- Automatic risk assessment

- Screening against PEP and sanctions lists

- Automatic AML manual

- Complete audit trail

Enterprise

- All AML features

- Automatic risk assessment

- Screening against PEP and sanctions lists

- Automatic AML manual

- Complete audit trail

Accounting Firms That Trust Qapla

See what other accounting firms say about using Qapla for AML compliance.

“We save hours every week. The system does everything automatically and we can always prove what we did.”

Anna Andersson

CEO, Ekonomi & Partners AB

“During our last inspection, we could show everything immediately. No problems, no questions. It was easy.”

Erik Johansson

Founder, Redovisningsbyrån Stockholm

“Qapla has made AML compliance go from a headache to something that just works. Highly recommended.”

Maria Larsson

Compliance Manager, EkonomiGruppen

Ready to Get Started?

Start with a one-month free trial. No commitments, cancel anytime.

No credit card • No binding • Fast start

Frequently Asked Questions

Find answers to the most common questions about our platform, features, and services. If you need more help, feel free to reach out to our support team.

View All FAQs